- News

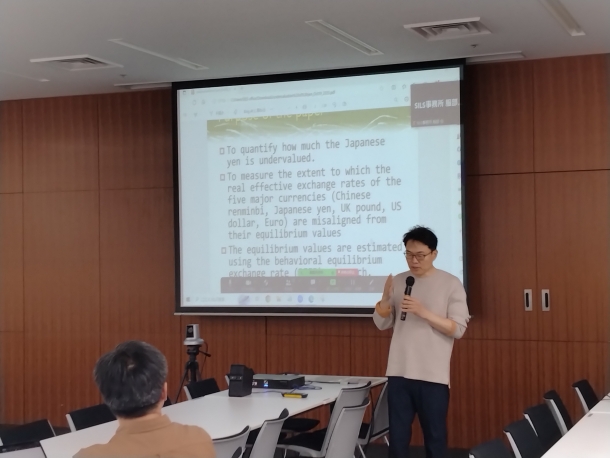

- [SILS Faculty Seminar] How much is the yen undervalued?

[SILS Faculty Seminar] How much is the yen undervalued?

![[SILS Faculty Seminar] How much is the yen undervalued?](https://www.waseda.jp/fire/sils/assets/uploads/2023/11/DSC_0241-1-940x627.jpg)

- Posted

- Tue, 21 Nov 2023

- Lecturer: BAAK Saang Joon

*Lecturer Information: https://w-rdb.waseda.jp/html/100000811_ja.html?k=baak - Title: How much is the yen undervalued?

- Day and Time: October 19, 2023 18:30PM

- Abstract:

The main purpose of this seminar is to quantify how much the Japanese yen is undervalued. For the purpose, this seminar measures the extent to which the real effective exchange rates of the five major currencies (Chinese renminbi, Japanese yen, UK pound, US dollar, Euro) are misaligned from their equilibrium values.

The equilibrium values are estimated using the behavioral equilibrium exchange rate (BEER) model, and economic fundamentals such as relative terms of trade, relative price of nontrade to trade goods, real interest rate differentials, and trade balance ratio to trade volume are employed to assess the equilibrium exchange rate for the period from 1991Q1 to 2022Q1.

The empirical test and estimation results indicate that the BEER model well explains the dynamics of the five currencies. All four fundamental variables estimated by the dynamic OLS approach have significant coefficient values consistent with economic theories. In addition, the goodness of fit is fairly high. The exchange rate misalignments measured using the estimates of the BEER model show that the Chinese renminbi and the euro are relatively close to equilibrium compared to other three currencies.

The yen and the UK pound are substantially undervalued recently while the US dollar has been overvalued for the last several years. The yen is quantified to be 10 to 20 percent undervalued compared to fundamental economic variables of Japan.