U.S. Fiscal Deficits: Public Interest and the Pandemic’s Influence

Mon, Dec 7, 2020-

Tags

Mieko Nakabayashi

Professor, Faculty of Social Sciences

As the novel coronavirus continues to run rampant, the United States has paid a heavy price. In mid-May, the number of infected people reached 1.5 million and deaths passed 90,000. Economic damage from the lockdown, which began in March, is impacting people’s lives, and COVID-19 is the largest political issue heading into the presidential and congressional elections six months away. Enormous fiscal measures are inevitable, and budget deficits are expected to rival those during World War II. The pandemic will end eventually, but the historic deficits will remain. Will we see a revival of debates over fiscal discipline?

The novel coronavirus and U.S. fiscal measures

The U.S. unemployment rate rose to 14.7% in April, the worst since World War II. Some predict that it may surpass 20% by June. [1] As illustrated by famous apparel companies and department stores going bankrupt, the pandemic is also an economic crisis. In a bipartisan act, the U.S. Congress passed three coronavirus relief bills: a first package of $8.3 billion including vaccine development on March 6; a second package of $104 billion centered on enhanced unemployment benefits on March 18; and a third package of $2.2 trillion (with an additional $480 billion on April 24) in economic support on March 27. One after another, these measures were passed and signed by President Trump. The Democratic Party has also passed an additional $3 trillion in new economic measures in the lower house of Congress, and President Trump and the Republicans are working on their own economic measures. On the content of the fiscal measures, for Republicans and Democrats to agree on principles is difficult. In May, Congressional officials were saying that getting something done by the Independence Day holiday in July would be considered success.

Of course, all these emergency fiscal measures increase budget deficits. According to estimates by the U.S. nonprofit Committee for a Responsible Federal Budget [2], this year’s budget deficit will be $3.8 trillion (18.7% of GDP) and $2.1 trillion in 2021. Even so, the same nonprofit which is normally tough on fiscal responsibility, stated that there should be no hesitation on fiscal measures considering the catastrophic nature of the current situation.

The public’s interest in fiscal discipline has already changed

According to a Pew Research survey announced on February 20, 2019, (conducted January 9 to 14, 2019) the public’s interest in fiscal discipline is declining. Coming early in the new year, the results reflect the lack of debate on the issue in the 2018 midterm elections just before.

The survey asked respondents whether fiscal deficits for the president and Congress are: 1) most important; 2) somewhat important; 3) not very important; 4) budget should not be balanced; or 5) don’t know. In the 2019 new year’s survey, 48% said “most important,” the lowest since 2013. In the past, there was high interest in 1994 with 65% and in 1997 with 60%, but due to the 9/11 terror attacks, the result in 2002 fell to 35% and was in the 50s for years afterward. In 2013, coinciding with single-year fiscal deficits reaching $1 trillion from 2009 to 2012 under the Obama administration, “most important” responses once rose to 72%, but the decline after that continues to this day. By political party, the decline of concern among Republican supporters is striking. Their interest in fiscal discipline fell from 82% in 2013 to 54% in 2019.

The role of politics in an election year

The decline of concern among Republican supporters coincided with the birth of the Trump administration. Compared to Democrats, the Republican party is fundamentally more conservative, advocating for fiscal discipline. The Tea Party movement within the Republican party received much attention in the 2008, 2010 and 2012 elections. The stubborn focus on balanced budgets and resistance to big government of representatives elected with Tea Party support are fresh in our memory, but the election of President Trump, who is not a traditional Republican politician, may have contributed to the change in interest in fiscal discipline among the Republican base. In their 2018 midterm election strategy, many Republican representatives were influenced by the immense power of the president’s messaging.

In the Democratic party as well, there was once a faction represented by the group called Blue Dogs, who emphasized fiscal discipline, but recently the left-wing faction of big government proponents, like Senator Bernie Sanders and Representative Alexandria Ocasio-Cortez, are gaining influence. In the run-up to the 2020 presidential election, former Vice President Joe Biden, the centrist presumed nominee, gives great deference to the party’s left wing. The very liberal Ocasio-Cortez, who is heavily influenced by the defeated presidential candidate and self-described democratic socialist Sanders, was appointed to the task force which advised Biden on six policy fields. This strengthening of liberal influence promotes greater public spending and may reduce interest in fiscal discipline for some time.

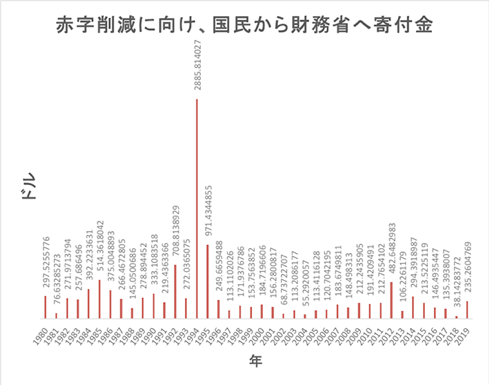

In the recent past, the biggest election where balanced budgets were a top issue was the 1994 midterms, when the Republicans won a landslide referred to as the conservative revolution. While this a different kind of data from the Pew Research survey above, the graph below reflects the level of interest in fiscal discipline, which shows the amount donated by the people to the Treasury’s Gift Contributions to Reduce Debt Held by the Public from 1980 to the end of 2019. As those donations steeply increased in 1994, politics moved in step with the fervor. Fiscal deficits decreased until the federal budget was balanced in 1998. From there and since the 9/11 terror attacks, the political driving force for fiscal balance has been lost, and fiscal balance has not been achieved.

Figure 1: A graph of gift contributions to the U.S. Treasury for public debt reduction based on the U.S. Department of the Treasury Bureau of the Public Debt data. (Credit: Mieko Nakabayashi; the y-axis represents U.S. dollars ($), the x-axis represents the year)

For the public to lose interest in fiscal discipline during a pandemic is natural. Still, since the pandemic will not last forever, it is possible that fiscal issues may return to prominence after the pandemic with a never-before seen number in deficits. If fiscal health is seen as necessary, America’s past experiences to see where and how the political motivation can be found should be considered.

In the current situation, neither party will naturally welcome a debate on fiscal discipline in this year’s presidential election. If interest in fiscal discipline is to return to the arena of politics, it will surely be some time after the pandemic when the public’s interest rises to drive politics.

References

[1] Statement by U.S. Treasury Secretary Mnuchin at May 19 Senate Banking Committee hearing.

[2] “Budget Projections: Debt Will Exceed the Size of the Economy This Year.” CRFB, April 13, 2020.

[3] “Fewer Americans view deficit reduction as a top priority as the nation’s red ink increases.” Pew Research Center, February 20, 2019.

Profile

Mieko Nakabayashi

Professor, Waseda University Faculty of Social Sciences

Professor Mieko Nakabayashi was born in Fukaya, Saitama in Japan as the eldest of three daughters from a farming family. She holds a doctorate in international public policy from Osaka University and a Master’s degree in political science from Washington State University. Professor Nakabayashi is a former member of Japan’s House of Representatives (2009 – 2012).

During her 14 years living in the U.S., Professor Nakabayashi obtained permanent residency and served as a Republican staff member of the U.S. Senate Budget Committee for approximately 10 years. She was named the 1994 Woman of the Year (politics) by Nikkei Woman magazine, and carried the Olympic torch at the 1996 Atlanta Games.

After returning to Japan in 2002, Professor Nakabayashi has held various positions, including: research fellow at the Research Institute of Economy, Trade and Industry (RIETI); associate professor at Atomi University; visiting scholar at Johns Hopkins University; and visiting professor at Renmin University of China. She has also served as commissioner on Fiscal System Council of the Ministry of Finance; member of the International Committee of the Council for Science and Technology at the Ministry of Education, Culture, Sports, Science and Technology; and member of the Radioactive Nuclear Waste Subcommittee at the Agency for National Resources and Energy in the Ministry of Economy, Trade and Industry. She became associate professor at Waseda University in 2013 and resumed her current position in 2017.

Publications

Her major publications include: “Fiscal Reform of Japan” (Toyo Keizai, 2004, co-author); “Citvic Literacy” (Kyoiku-Shuppan, 2005, co-author); “New Schedule for Administrative and Fiscal Reform” (Gyosei Shuppan, 2006, co-author); “A Challenge to Obama & America” (NPO Research Center, Osaka University, 2006, co-editor); “Simple Habits of Globally Competitive Professional Women” (PHP Research Institute, 2012); “President Trump and Congress” (Nihon Hyoronsha, 2017); and “How to Understand President Trump” (Gentosha, 2018).