Predicted Nankai megaquake could cause 11.1% dip in Japan’s GDP

Wed, Sep 11, 2019The 2011 Great East Japan Earthquake resulted in a massive tsunami that not only devoured buildings, swept away homes and took the lives of ordinary people, but also had an impact on the country’s economy. Scientists have predicted that a megaquake more destructive than the Great East Japan Earthquake is likely to occur along the Nankai Trough within the next three decades. The question is, just how much damage will the Nankai earthquake cause if it ever breaks out?

Using the K Computer and supply chain data obtained from over one million Japanese companies, Waseda Professor Yasuyuki Todo and University of Hyogo’s Professor Hiroyasu Inoue conducted stimulation analyses to examine the economic impacts of the Nankai earthquake if it hits Japan. Based on the results of the analysis, it is predicted that the megaquake will cause an 11.1% dip in the country’s GDP (about 4.5 times of that of the Great East Japan Earthquake). Of this numerical figure, only 0.5% is attributed to direct effects caused by earthquakes and tsunami while the remaining 10.6% is due to disruption in supply chains.

The study was published in Nature Sustainability on August 12, 2019.

Research Background

After the 2011 Great East Japan Earthquake broke out, companies and firms in affected areas ceased to function normally and production stopped in many factories. This has caused a ripple effect on those outside affected regions, disrupting their supply chains, as supplier companies in areas hit by earthquakes and tsunami were not able to deliver materials to them. To date, the economic impacts caused by disruption in supply chains have been examined through the lens of macroeconomics using the Input-Output Tables (IOTs), which describe the sale and purchase relationships between producers and consumers within an economy. However, it is by examining them from the microeconomics point of view, i.e. studying the behavior and decision making of businesses, can we attain an accurate estimate of the ripple effect.

Examining the economic damage through microeconomics is heavily inspired by network science. In the business world, there are firms which act as giant hubs that have complex supply chain networks with an extremely large number of firms. When a firm within this large number of firms reduced its production (e.g. due to natural disaster), it will not only have an impact on the giant hub but also other firms connected to the giant hub through the complex supply chain network. As such, in order to fully estimate the economic damage caused by the ripple effect of an event, there is a need to study the networks between firms and companies. Nevertheless, such analysis method has not been adopted till this date.

Methodology

In order to estimate the size and persistence of the ripple effect of an event, Professor Todo and Inoue developed an agent-based model in which heterogeneous firms are connected through supply chains and applied it to the actual supplier-customer relations of about one million firms in Japan. They then used the 2011 Great East Japan Earthquake as the source of negative economic ripple effect to calibrate the model and examine how it propagates through supply chains. After which, they employed the model to predict the dynamic effect of the Nankai earthquake which is predicted to hit Japan in the near future. Finally, they experimented with different hypothetical networks to understand which network structures promote ripple effect of an event. The K computer is used to do the vast amount of calculations required by such analysis.

Research findings

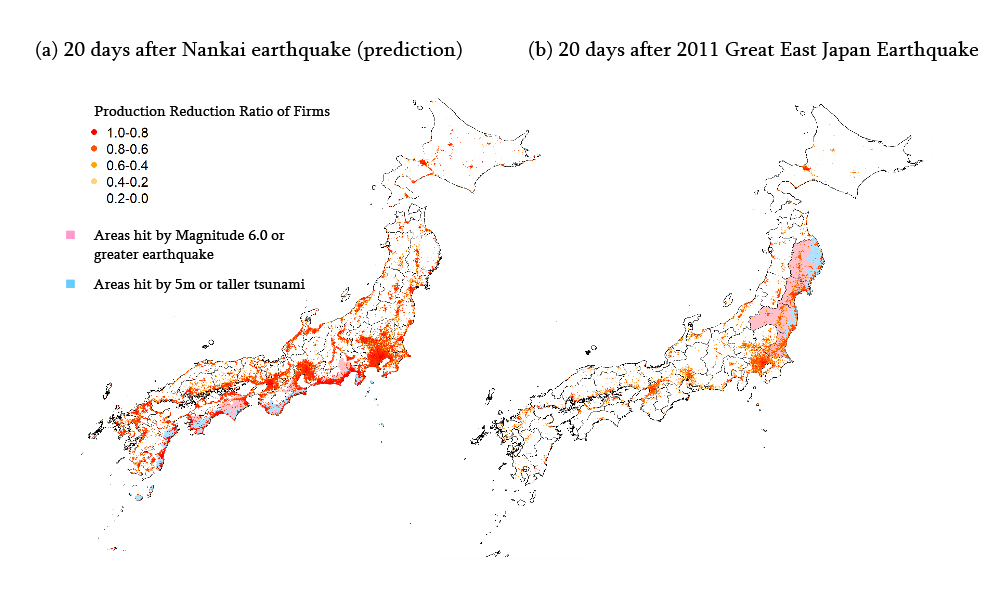

The effect on production of Japanese firms 20 days after the breakout of the Nankai earthquake is shown in figure 2. The red dots represent firms whose production will plummet below 40% of their production capacity before the earthquake, while the orange dots represent firms whose production will plunge into the 40 – 80% range (i.e. a 20 – 60% fall in production). The following video shows the daily change in production of firms predicted to take place after the Nankai earthquake occurs.

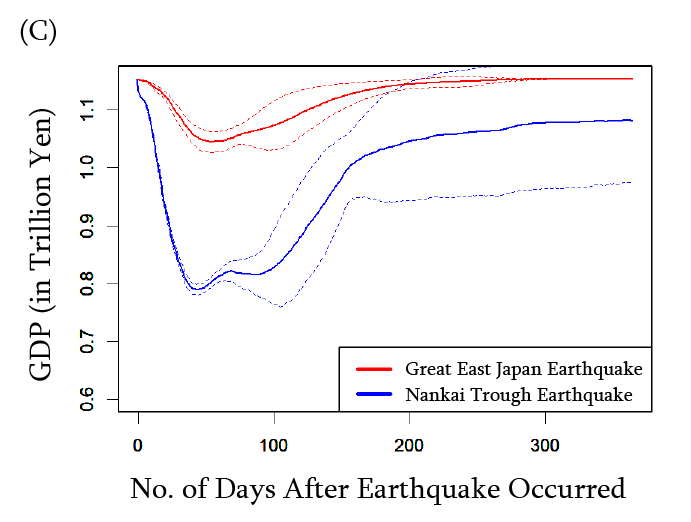

From the above video, it can be seen that the effect of the megaquake on production of firms will not only be restricted to affected areas but eventually propagate throughout Japan. After 40 days, the reduction in production will start to stabilize. Even so, by this point of time, most firms will only be producing less than half of their production capacity before the earthquake. This phenomenon is predicted to continue into the 100th day and will cause an overall 11.1% dip in the country’s GDP (4.5 times of that of the Great East Japan Earthquake). Of this 11.1% shrink, 0.5% will be due to direct effect caused by the earthquake and tsunami while the remaining 10.6% caused by disruption in supply chains (i.e. the ripple effects of the megaquake).

The reasons why economics effect caused by disruption in supply chains can be so huge and has a prolonged effect is attributed to (1) the existence of giant hubs in supply chain networks, (2) a looping effect caused by supplier companies purchasing final products and (3) substitution of components by supplier companies are not readily available.