Shedding Light on the Impact of the Bank of Japan’s Exchange-Traded Fund Purchase Program

Thu, Oct 9, 2025-

Tags

Shedding Light on the Impact of the Bank of Japan’s Exchange-Traded Fund Purchase Program

Researchers investigate the role of passive investors in the equity lending market in this study

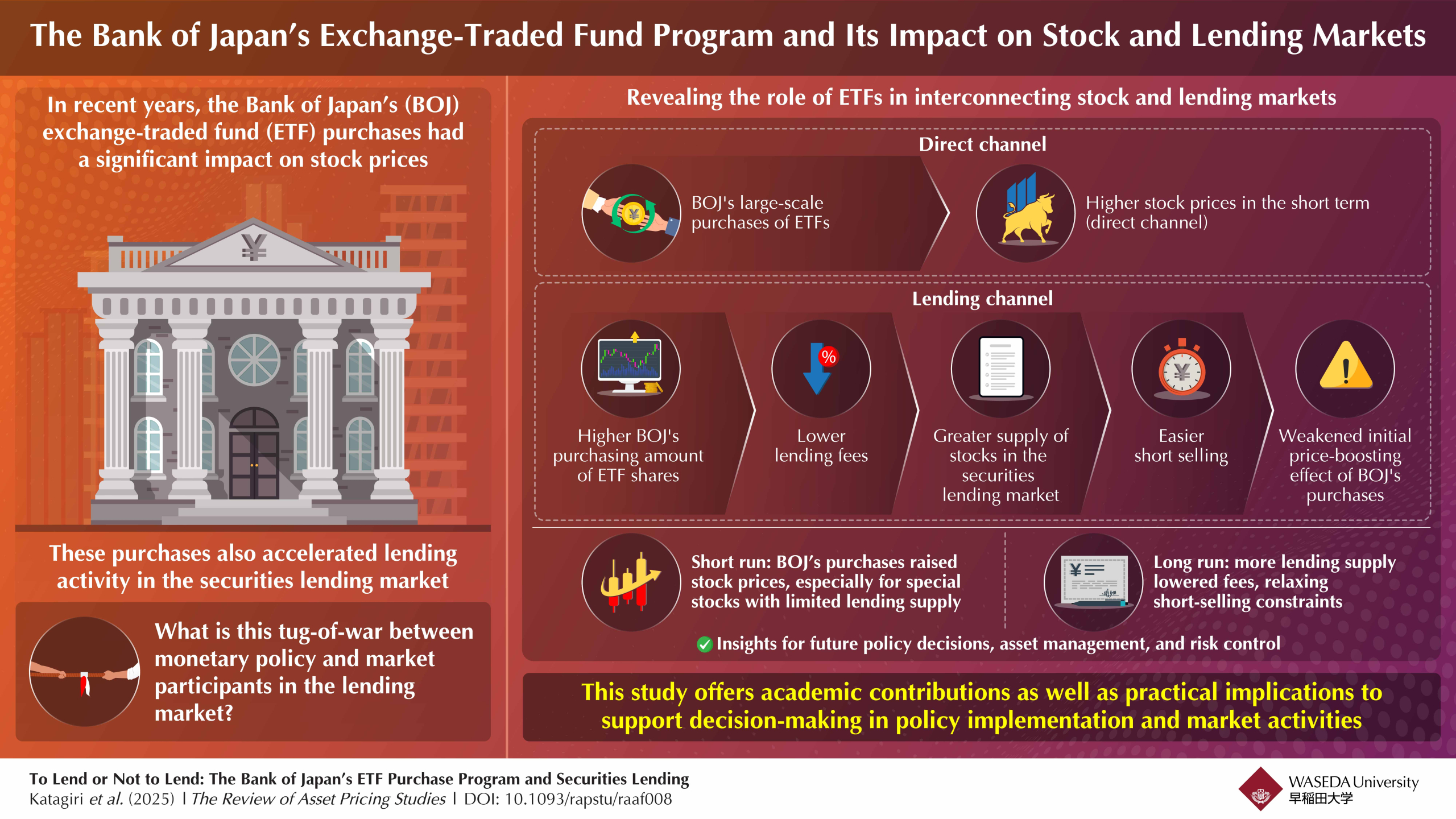

The Bank of Japan’s Exchange-Traded Fund (ETF) purchases have had a substantial impact on stock prices. Researchers from Waseda University and the Bank of Japan reveal that the large-scale purchases of ETFs by the Bank of Japan have not only directly pushed up stock prices in the equity market but have also had a significant impact on the securities lending market, offering practical implications that can support decision-making in policy implementation and market activities.

It is widely recognized that the Bank of Japan’s Exchange-Traded Fund (ETF) purchases had a substantial impact on stock prices. Market participants and media reports have often highlighted that the policy distorted market valuations. At the same time, they pointed out that ETF management appeared to accelerate stock lending activity as the number of ETFs held by the Bank of Japan increased over time. This pattern suggests that the stock market, particularly the lending market, has mechanisms that enhance market efficiency and counteract the effects of the Bank of Japan’s policy.

Recently, a team of researchers from Japan, led by Dr. Junnosuke Shino, Associate Professor at the Faculty of International Research and Education, Waseda University, along with Dr. Mitsuru Katagiri from the Faculty of Commerce, Waseda University, and Dr. Koji Takahashi from the Institute for Monetary and Economic Studies, Bank of Japan, has shed new light on this tug-of-war between monetary policy and market participants in the lending market. Their findings were made available online and published in The Review of Asset Pricing Studies on 04 September 2025.

The key finding of this study is that the Bank of Japan’s large-scale purchases of ETFs in recent years have not only directly pushed up stock prices in the equity market but have also had a significant impact on the securities lending market, where stocks are borrowed and lent for activities, such as short selling.

“While previous studies have focused on the price-boosting effects of the policy, our research reveals a mechanism whereby increased ETF purchases by the Bank of Japan lead to a greater supply of stocks in the securities lending market, making short selling easier and thereby weakening the initial price-boosting effect of the Bank of Japan’s purchases,” explain the researchers.

This is a novel finding, indicating that through ETFs—which have rapidly gained prominence worldwide in recent years—the equity and securities lending markets are interlinked and jointly influence stock prices.

Notably, this study is based on actual data from the stock market, making the findings directly relevant to the real world. In particular, it suggests that the stock market functions efficiently to some extent. In other words, although an investor may aim to constrain stock supply in the spot market to push up prices through large-scale purchases, the stock lending market acts as a mechanism that helps mitigate distortions in stock prices.

They highlighted, “Our work is important in that it reveals how central bank asset purchase policies can influence financial markets and asset prices not only through direct channels, but also via a variety of indirect mechanisms. This highlights the need to assess the impact of such policies from a broader perspective when designing future asset purchase programs or financial market systems. In particular, given that the Bank of Japan still holds tens of trillions of yen worth of ETFs, the study provides a valuable viewpoint for considering the potential effects that may arise as the Bank gradually unwinds these holdings in the future.”

Furthermore, the findings of this research are valuable for foreign central banks and international institutions as well. Japan’s unprecedented experience of large-scale purchases of equity index-linked ETFs by a central bank could serve as a reference point for future policy decisions. For investors and market participants, understanding the impact of ETFs on the securities lending market also offers useful insights for asset management and risk control.

In this way, the present study offers not only academic contributions but also practical implications that can support decision-making in policy implementation and market activities.

Reference

Title of original paper: To Lend or Not to Lend: The Bank of Japan’s ETF Purchase Program and Securities Lending

DOI: 10.1093/rapstu/raaf008

Journal: The Review of Asset Pricing Studies

Article Publication Date: September 4, 2025

Authors: Mitsuru Katagiri1, Junnosuke Shino1, and Koji Takahashi2

Affiliation:

1Waseda University, Japan

2Bank of Japan, Japan

About the Authors

Dr. Mitsuru Katagiri is an Associate Professor in the Faculty of Commerce at Waseda University, Japan. He earned his Ph.D. in Economics from the University of Pennsylvania, U.S., in 2011.

Dr. Junnosuke Shino is an Associate Professor in the Faculty of International Research and Education at Waseda University, Japan. He received his Ph.D. from Rutgers University, U.S., in 2011.

Mr. Koji Takahashi is a Senior Economist and Head of the Economic Studies Group at the Institute for Monetary and Economic Studies, Bank of Japan. He obtained his Ph.D. in Economics from the University of California, San Diego, U.S., in 2017