ABE Tatsuya, Assistant Professor

Analysis of the effects of an eco-car tax reduction and subsidy policy by combining micro and macro data

The focus of my work involves empirical environmental economics. This field involves validating the effectiveness of the government’s environmental policies using actual data. Specifically, I tried to evaluate environmental policies that use market mechanisms, such as emission trading systems and carbon taxes, by clarifying their impacts on the economy and the environment.

In a recent study, I examined the effects of eco-car tax cuts and eco-car subsidies in Japan. The eco-car tax reduction is a system for reducing and exempting automobile-acquisition taxes and automobile-weight taxes when consumers purchase cars. The eco-car subsidy is a system that provides subsidies to consumers when they purchase cars. In this way, a system that imposes a surcharge on cars with poor fuel efficiency, and gives rewards to eco-friendly cars for the purpose of reducing greenhouse gas emissions from cars is generally referred to as a “feebate system.”

In order to verify the policy effect, I developed an economic model and ran a policy simulation. Mainly, I used two types of data to estimate the economic model. The first was a household survey our team had conducted back in 2013. From 548 households that had purchased a new car within the past five years, I collected data on household attributes (income, number of family members, age of the head of the household, and the like) as well as information on car purchases and use such as when and what kind of car was purchased, and how long it was driven. The second was macro-level data that aggregated characteristics such as sales volume, price, weight, and fuel economy of new car models sold in Japan between 2006 and 2013.

By building a supply/demand model for the automobile market, I was able to investigate counterfactual situations such as what the sales volume and price of each automobile model would have been if the feebate policy had not been implemented. Through such simulation analysis, I was able to clarify the net effect of the feebate policy.

Driving demand is stimulated by improved fuel efficiency, partially offsetting the CO2 reduction effect

According to my analysis, the economic effect of the eco-car tax reduction and the subsidy policy in 2012 was ¥590 billion, and the effect of carbon dioxide reduction by improving the average fuel efficiency of newly purchased new cars was 43,100 tons. While there were such reductions, it was also revealed that eco-car tax cuts and subsidies are causing a “rebound effect” that contributes to increasing carbon dioxide. The rebound effect refers to the phenomenon where improved fuel efficiency reduces the driving cost per kilometer, stimulating driving demand and consequently increasing fuel consumption. Therefore, if there is a rebound effect, even if environmental policies such as feebates are implemented to improve the fuel efficiency of automobiles, the fuel consumption will not decrease as much as originally expected. From the analysis, I found that the rebound effect generated from the implementation of the feebate offsets the carbon dioxide reduction effect that would have been obtained by improving fuel efficiency by about 7%. While feebates increased automobile sales and were somewhat effective as an economic measure, it has been shown that the effect of reducing greenhouse gases would be smaller than expected before the introduction of such a policy.

Based on the analysis results I obtained in this study, I believe that the emission reduction effect of feebates is limited. On the other hand, fuel taxes such as gasoline tax and carbon tax that impose a tax according to CO2 emissions are effective policy measures to reduce the mileage of cars and reduce CO2. However, the Japanese government is cautious about raising the tax rate because it is concerned that the proportion of income taxed will be “regressive,” which is higher for low-income people.

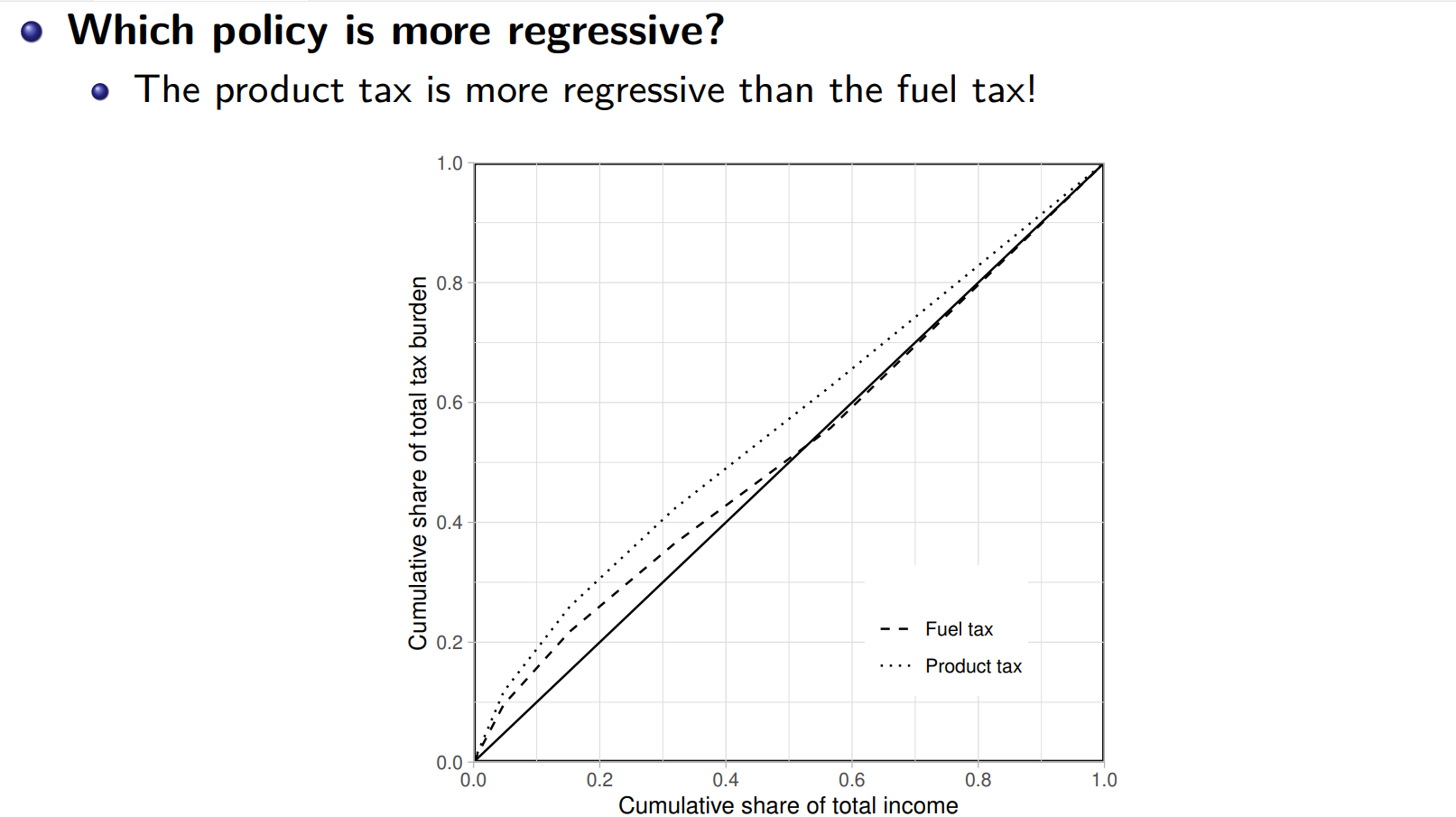

Fuel tax is less regressive than an automobile tax and a weight tax

Therefore, in order to find out how regressive the fuel tax is, I used the above model to calculate the actual tax burden on households (Fig. 1). Here, I estimated and compared the amount of welfare losses that were incurred by households by imposing fuel taxes and other automobile-related taxes. As a result, it was found that although the fuel tax is a regressive tax, it is less regressive compared to the automobile tax and the automobile weight tax.

Fig. 1 Comparison of Regressivity of Fuel Tax and Automobile Tax/Automobile Weight Tax

Tax paid according to distance driven from the tax charged simply for owning a car

My policy proposal is to change the current system of automobile tax and automobile weight tax, which are levied annually just for owning a car, to a fuel tax or carbon tax (or mileage tax) that people pay according to the amount of fuel such as gasoline that they consume (or the distance driven). By doing so, my analysis shows that the reduction of greenhouse gases can be implemented more efficiently and equitably. Even if the automobile tax and the automobile weight tax are abandoned, it will be possible to secure tax revenue by increasing the tax rate of the fuel tax, and I believe that the introduction of a tax system that further promotes the replacement of fuel-inefficient cars will also promote the popularization of eco-cars.

In the future, I will also study the policies of countries other than Japan. I aim to clarify the impact of carbon taxes and emission trading systems on the economy and the environment.

Coverage/Constitution: INOUE Yuko

Cooperation: Graduate School of Political Science, Waseda University, J-School