Capital Structure and Liabilities of a Corporation

Corporate finance refers to the academic discipline that focuses on capital financing and investment from corporations and investors while drawing upon economic theories and statistical data on dividend policies, etc., to offer guidance in their decision-making. Results from these studies can be useful for enhancing the value of an enterprise.

My current research focuses on capital financing methods, which can be broadly divided into two categories: (1) equity financing or (2) debt financing. Equity financing is achieved by issuing new stock. However, debt financing is sourced from liabilities by borrowing funds or issuing debt instruments.

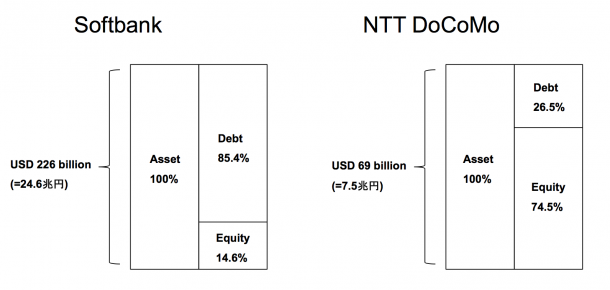

To illustrate, let us compare the capital structures of Japan’s leading mobile phone carriers Softbank and NTT Docomo (Figure 1). These two capital structures significantly differ from each other. In NTT Docomo’s case, the liabilities equal 26.5% of assets as opposed to 85.4% for Softbank. The stark difference between the two is Softbank’s overwhelming reliance on liabilities for its capital financing. Evidently, differences in management policies heavily influence capital financing. At this point, one may ask: “Why would a corporation prefer increasing their liabilities when raising capital?

Figure 1. Comparison of Softbank’s and NTT Docomo’s Capital Structures Compared with NTT Docomo, Softbank’s liabilities relative to its assets are exceedingly high.

Optimal Capital Structure Decisions Based on the Trade-off Theory

The leverage ratio refers to the proportion of debt in relation to equity, or the debt-to-equity ratio. When utilizing debt to expand business, fluctuations in earnings may become amplified as if they were being moved by an invisible lever—hence the term “leverage.”

Debt financing has both advantages and disadvantages. One of the most common theories explaining the leverage ratio is “trade-off theory.” When a corporation increases its liabilities, the interest payments are tax-deductible. Initially, the tax-saving effect raises the corporation’s value. However, if the increase in liabilities becomes excessive, then bankruptcy risk rises and the corporation’s market value begins to fall. For this reason, the corporation needs to decide on an optimal leverage ratio that sets the appropriate balance. This is the essence of trade-off theory where the tax rate pre-eminently affects capital structure.

Numerous economists have previously used actual data within empirical studies of this theory. For instance, Gordon and MacKie-Mason (1990) analyzed capital structures after the Reagan Administration’s 1986 tax reform in the United States when federal corporate taxes were reduced. Based on the trade-off theory, contrary to expectations, leverage ratios did not fall.

Further, Heider-Ljungvist (2015) analyzed capital structures subsequent to corporate tax rate changes in the United States spanning over twenty years. Their analysis revealed that when tax rates increased, the average leverage ratio rose. However, when tax rates declined, a corresponding leverage decrease did not occur. Thus, empirical research results showed that the trade-off theory does not always apply. Indeed, at first glance, it would seem that this theory fails to measure up to reality.

Simulation to Understand the Empirical Significance of the Trade-off Theory

My co-researchers, Christopher Hennessy, Ilya Strebulaev and I have created a new economic model to clearly demonstrate the previously mentioned results which do not necessarily contradict the trade-off theory. This model replicates corporate leverage ratio selections which maximize shareholder values. The premise is that they will choose leverage ratios that trade off tax savings against bankruptcy cost. Utilizing this model, we performed a simulation analysis of how a corporation’s capital financing methods change when the tax rate changes.

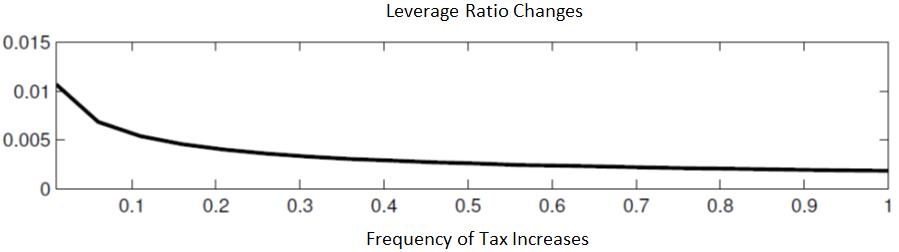

According to the previously mentioned empirical studies, changes in the corporate tax rate do not necessarily elicit changes in leverage ratios. First, we attempted to clarify this phenomenon within our simulation model. Figure 2 shows changes in the leverage ratio relative to the frequency of tax rate changes. According to the simulation results, if the tax rate frequency changes, then the leverage ratio tends to approximate “0”. When tax rate changes, corporations react by altering their leverage ratios. However, when tax rates change too frequently, they tend to avoid adjusting them because any change may have to be reversed soon thereafter. Although these are nothing more than simulation results, they draw our attention to the theoretical possibility that the same phenomenon could actually occur if tax rates are constantly changed in real life.

Further, when regression analysis is performed on these results, the changes in the leverage ratio for much of the simulation are statistically insignificant. Based on this observation, it cannot be said that the trade-off theory does not apply to reality solely based upon the previously mentioned empirical research results.

Figure 2. Changes in Leverage Ratios in Reaction to Tax Increases: Changes to the leverage ratio are more difficult to observe when taxes continually increase.

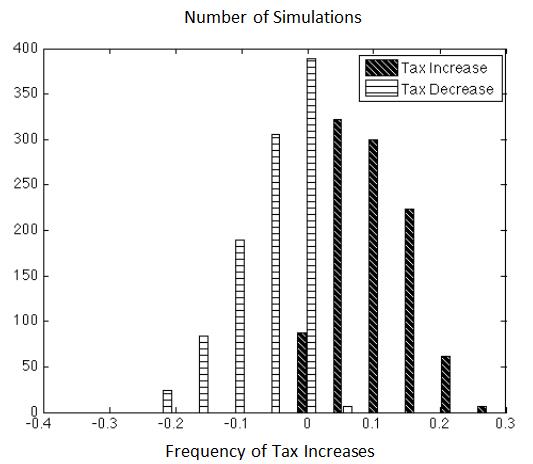

Next, the empirical studies showed that when corporate taxes rise, leverage ratios change. On the other hand, they tend to remain the same when taxes are reduced. We can also replicate these asymmetrical reactions in our simulation. Figure 3 shows the results of our analysis of capital financing activities that correlate with changes to the tax system. In this figure, when taxes rise, many corporations increase their liabilities. When tax rates decline, many will not do anything. Some find this tendency inconsistent with the trade-off theory.

The simulation was performed based on the trade-off theory itself. The asymmetrical tendency may be explained based on this theory as well. If liabilities are not reduced following a tax reduction, a corporation will face high bankruptcy costs. However, those costs would be borne by the creditors, so there is not any incentive for the stockholders to reduce liabilities and lay out their own equity. Hence, a tax reduction does not necessarily entail a lowering of leverage ratios.

Figure 3. Asymmetrical Changes in Leverage Ratios in Reaction to Tax Changes Increases or Decreases: When corporate taxes are increased, many corporations boost capital financing which increase their liabilities. If taxes are reduced, many do not alter their capital financing activities such as decreasing their liabilities.

Toward a Better Understanding of Economics

Pursuing research on capital financing in corporations has been very engaging, and has provided a close-up view of corporations facing real-life situations and decision making. Additionally, I engage in research on asset pricing and securities design, such as the architecture of financial instruments for optimizing efficient capital financing. In my view, not only will the research results help a corporation increase its value, but they will also provoke a better macroeconomic understanding of the economy as a whole. In the future, I look forward to offering policy proposals on financial regulatory and tax systems in order to make valuable contributions to society.

Interview and Composition:Narumi Sato

In cooperation with: Waseda University Graduate School of Political Science J-School