This was a public lecture inviting two economists from the IMF’s research department: Dr. John Christian Bluedorn and Dr. Jean-Marc Natal. They are in charge of writing IMF’s by-annual economic report, World Economic Outlook. We are lucky to have a fresh topic because this report was published a week before and covered in news media all over the world. Dr. John Bluedorn and Dr. Jean-Marc Natal are not only prominent policy analysts but also have academic backgrounds working at higher education institutions. Thanks to that, they provided a very accessible lecture to even undergraduate students with limited background in economics.

Dr. John Bluedorn first talked about the overview of the current global economy, which is based on the first chapter of the World Economic Outlook. He described the current economic situation as a “rocky recovery.” Although the global economy has been relatively stable compared to 2022, we still have risks in monetary policy tightenings, too much persistent inflation, government debt distress, slow growth in China, and geopolitical and economic fragmentation.

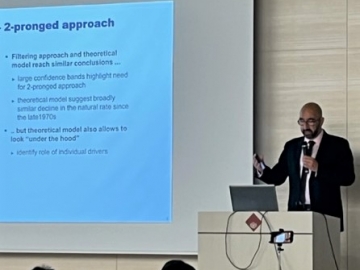

Next, Dr. Jean-Marc Natal discussed a more focused topic about the natural rate of interest from the second chapter of WEO. It is a hypothetical real interest rate if the economy has no boom or recession. This rate is an important anchor for long-term fiscal and monetary policies. Dr. Jean-Marc Natal explained the decreasing and converging trends of the measured natural rate of interest. These imply a long-term risk of monetary policy that effective lower bound likely binds again. For fiscal policy, the decreasing interest rate may provide rooms for active interventions; however, significant deficit reduction is still needed.

Each session had 30 min speech and 15 min Q&A discussions. A consecutive translation was provided. In total, 81 students in Japanese and English programs attended. Students actively asked a variety of questions in the Q&A sessions.