Professor Vikas Mehrotra

On December 26, 2022, the Center for Positive/Empirical Analysis of Political Economy invited Professor Vikas Mehrotra from the University of Alberta School of Business to give a special seminar entitled “The Demand and Voluntary Supply of Climate Disclosure”. Professor Mehrotra has long contributed to the TGU project to teach the regular course “Corporate Governance and M&A” every year at the Faculty of Commerce, Waseda University. This year, the special seminar was held both in person and online for not only commerce students, but graduate students and researchers in any field who were highly interested in the topic.

Professor Mehrotra reported on the impact of investor demand for climate risk information (CRI) on voluntary disclosure by the companies. In recent years, climate change risk has become one of the key management issues for the companies, and investors can request disclosure through shareholder resolutions and engagements in order to know the impact of climate change risk on a company’s financial position. In response, the company can generally disclose climate change risk information through CSR reports or CDP, or both. The proportion of S&P 500 companies disclosing climate change risk information through CSR reports or CDP has increased from 40% in 2010 to nearly 70% in 2020. What are the factors that encourage companies to disclose climate change risk information, and which disclosure tool do companies choose – CSR reports or CDP?

In this study, an analysis of S&P 500 companies from 2010 to 2020 reveals the following three key findings.

- Climate change risk disclosure is more active in companies with higher ownership by the so-called Big Three institutional investors (Blackrock, Vanguard and State Street). While the Big Three institutional investors encourage companies to disclose climate change risk information through engagement, no shareholder resolutions encouraging disclosure were found. Companies that disclosed climate change risk information through CSR reports were also more likely to do so through CDP.

- Companies with high CO2 emissions that publish CSR reports are less likely to disclose information through CDP. This result suggests that high CO2 emitters may avoid disclosing information through CDP but would rather disclose information in CSR reports where there is no format.

- Companies that started disclosing through CDP were found to have increased market liquidity and have lowered Scope 1 emissions.

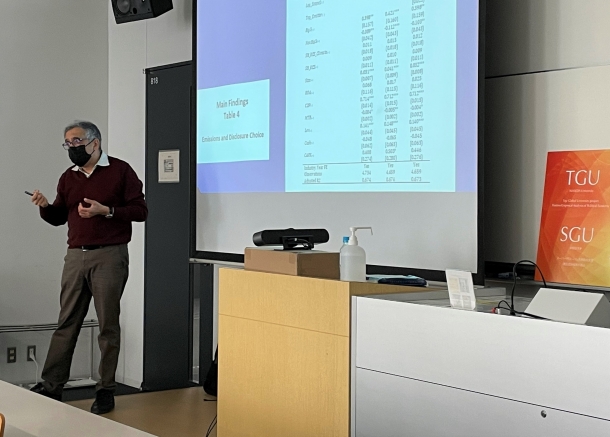

Around 30 postgraduate students and researchers attended the seminar in person or online. Participants raised various points and questions about the implications of mandatory disclosure of climate change risk information, leading to an interdisciplinary discussion.

Speaker profile

Vikas Mehrotra is Professor of Finance at the University of Alberta School of Business. Professor Mehrotra has a PhD (Finance) from the University of Oregon, USA, and a BTech (Chemical Engineering) from the Indian Institute of Technology, India. Dr. Mehrotra has been a past-President of the Northern Finance Association and has served as an inaugural director on its board from 2013-2017. He has been a visiting professor at the Institute for Economic Research at Hitotsubashi University in Tokyo and a Shimomura Fellow at the Research Institute at the Development Bank of Japan. Dr. Mehrotra’s work deals with family business, corporate restructuring, mergers and acquisitions, ESG, and international financial markets, and has been published in leading finance journals such as The Journal of Finance, The Journal of Financial Economics, The Review of Financial Studies and The Journal of Financial and Quantitative Analysis. His work has been cited in the Financial Times, The Wall Street Journal, BBC, The Economist, National Public Radio (NYC), and the National Post. He is member of the Canadian Sustainable Finance Network.

Professor Vikas Mehrotra (3rd from right) with selected participants